Ecosystem Report of 2024-2025

Ecosystem Report of 2024-2025

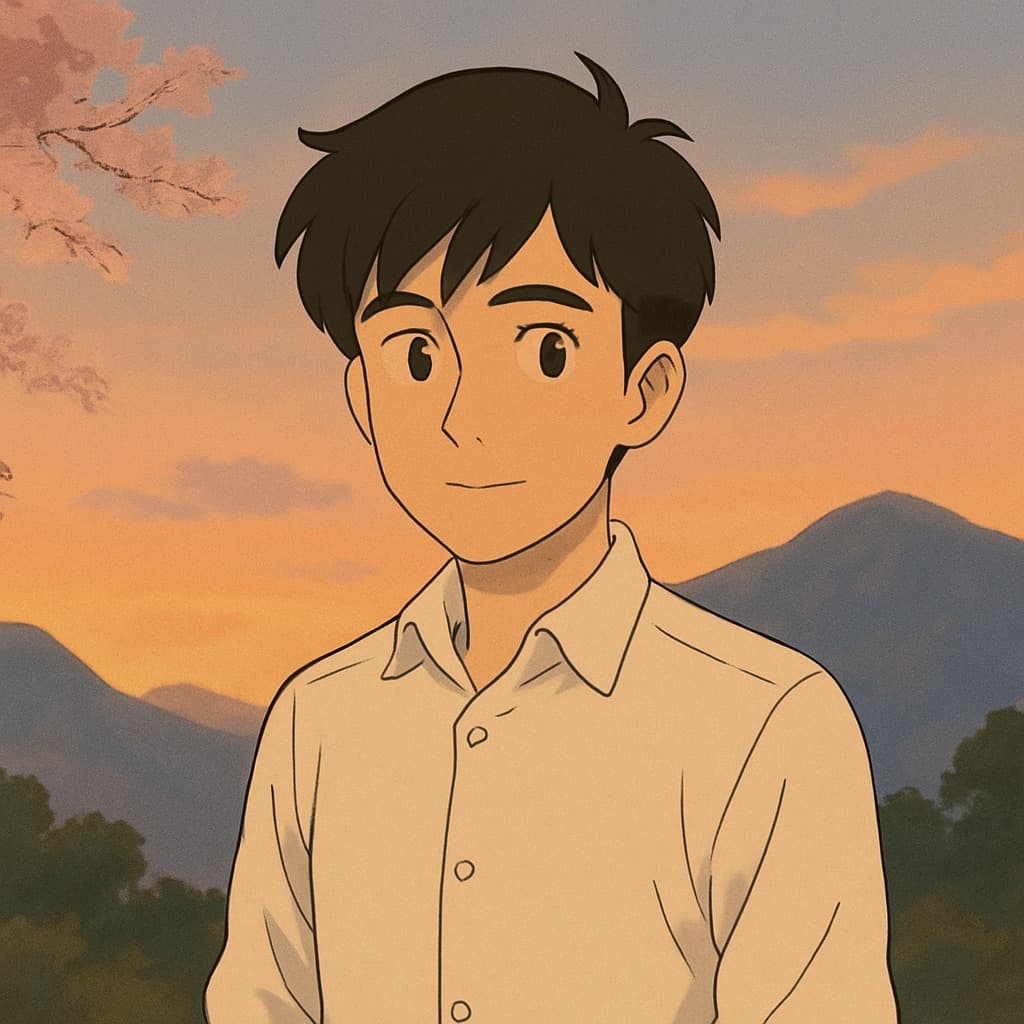

Over the past year, OpenConnect tracked 51 startups across Azerbaijan, capturing their progress, challenges, and impact. This study, covering nearly a third of the country’s estimated 146–300 startups, provides one of the most detailed snapshots of Azerbaijan’s emerging entrepreneurial ecosystem to date.

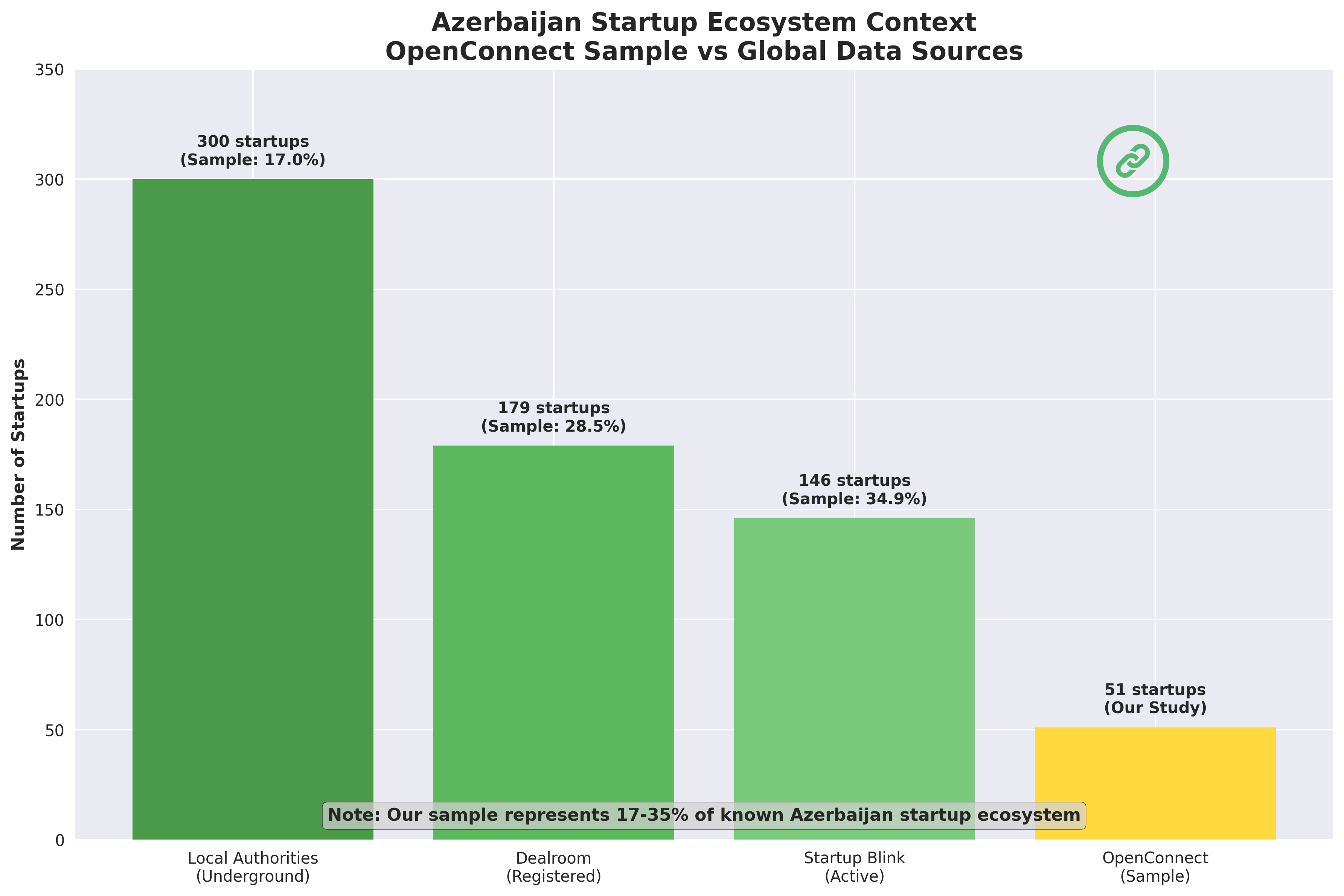

Survival and Growth

Startup life is never easy—and Azerbaijan is no exception. Just 27.5% of startups achieved positive outcomes (remaining active, pivoting, or exiting). Meanwhile, 41.2% failed outright and 31.4% slipped into dormancy—a state where ventures neither scale nor shut down completely. Dormancy stands out as a major ecosystem challenge, often reflecting limited resources or hesitation to close ventures fully.

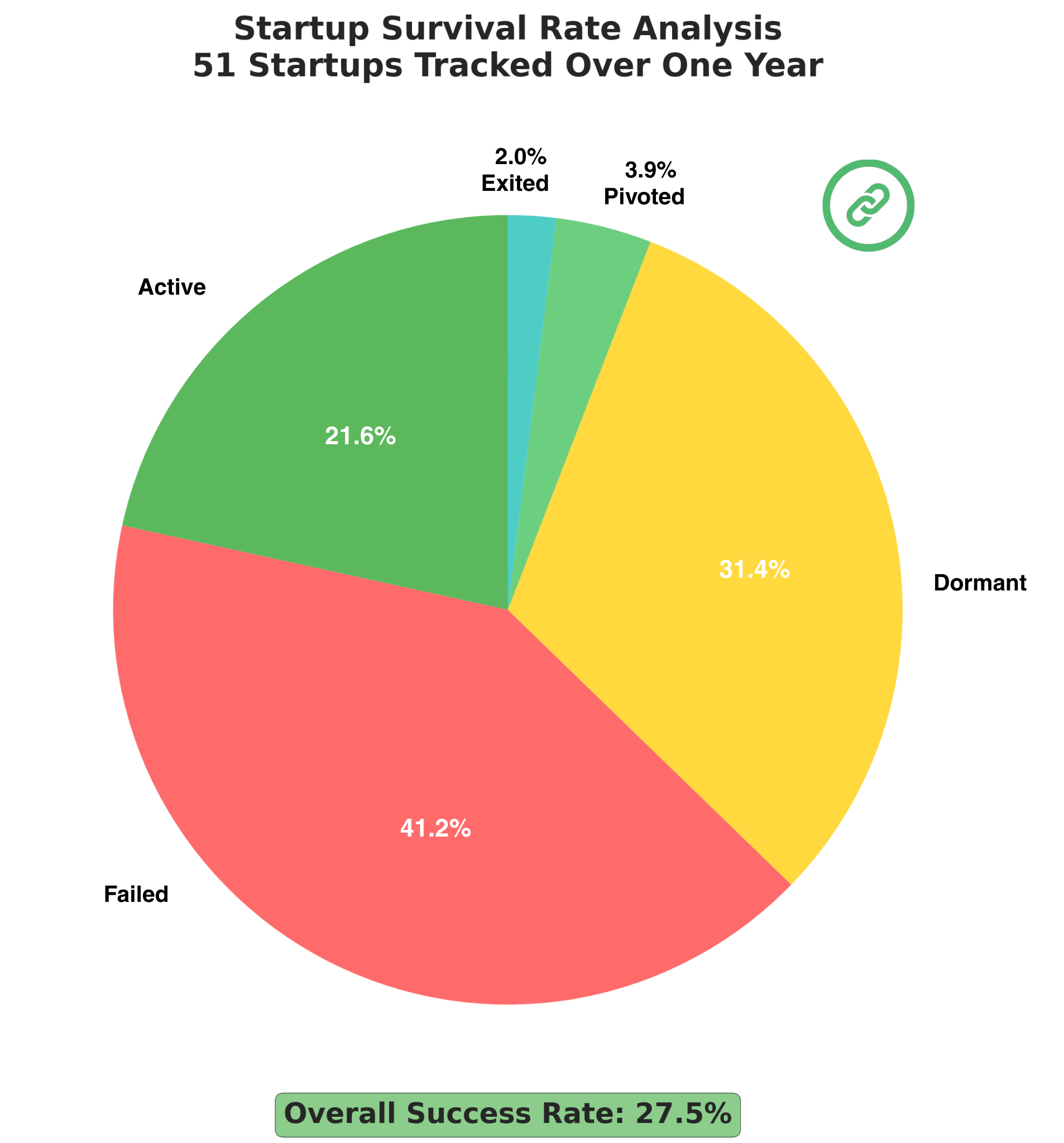

Funding Landscape

Access to capital remains a decisive factor. While 45.1% secured some form of funding, only 7.8% managed follow-up rounds—highlighting the growth-stage funding gap. Startups that did receive investment were over three times more likely to survive and created significantly more jobs. Accelerators were the leading source of funding (65.2%), followed by angel investors (21.7%) and government grants (13%).

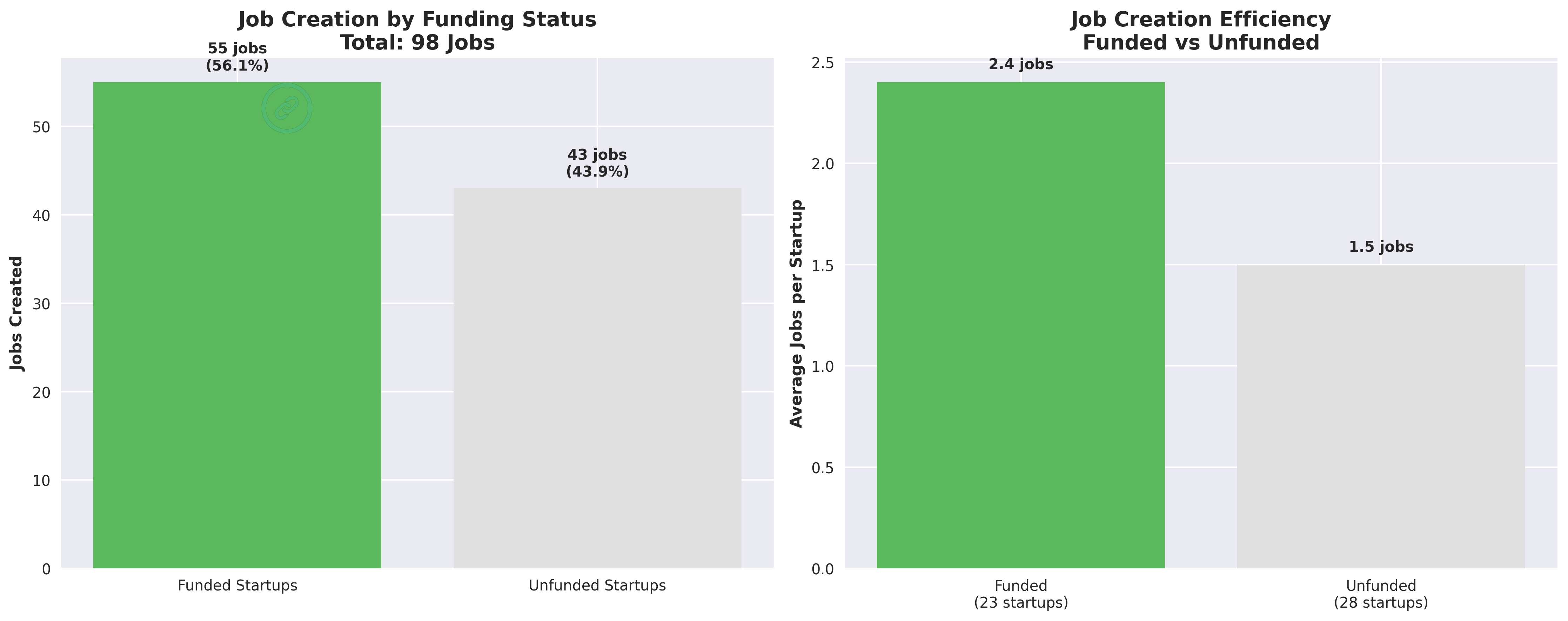

Economic Contribution

Together, the 51 startups generated 98 jobs, averaging 1.9 per venture. Funded startups created 1.6x more jobs than unfunded ones, reinforcing the link between capital and employment growth. Beyond numbers, these jobs nurtured technical talent and introduced international business practices into the local workforce.

Global Reach

Although most startups remain focused on domestic markets, 17.6% expanded internationally—a promising signal of global competitiveness. These ventures overcame barriers in marketing, regulation, and operations to acquire users abroad, showing that Azerbaijan can produce export-ready startups.

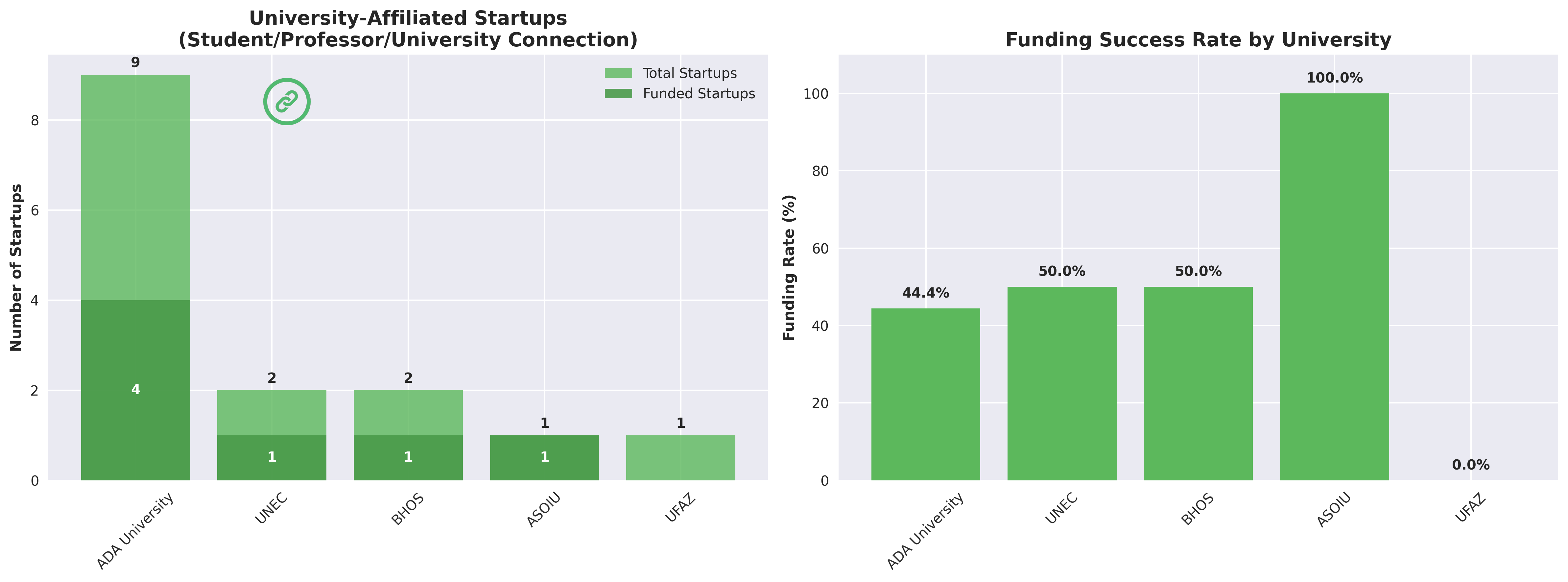

Universities as Launchpads

Academic institutions play a visible role: 29.4% of startups had university ties. ADA University alone contributed nine ventures, making it a clear leader in nurturing student and graduate entrepreneurship. This underlines universities’ potential as talent pipelines for the ecosystem.

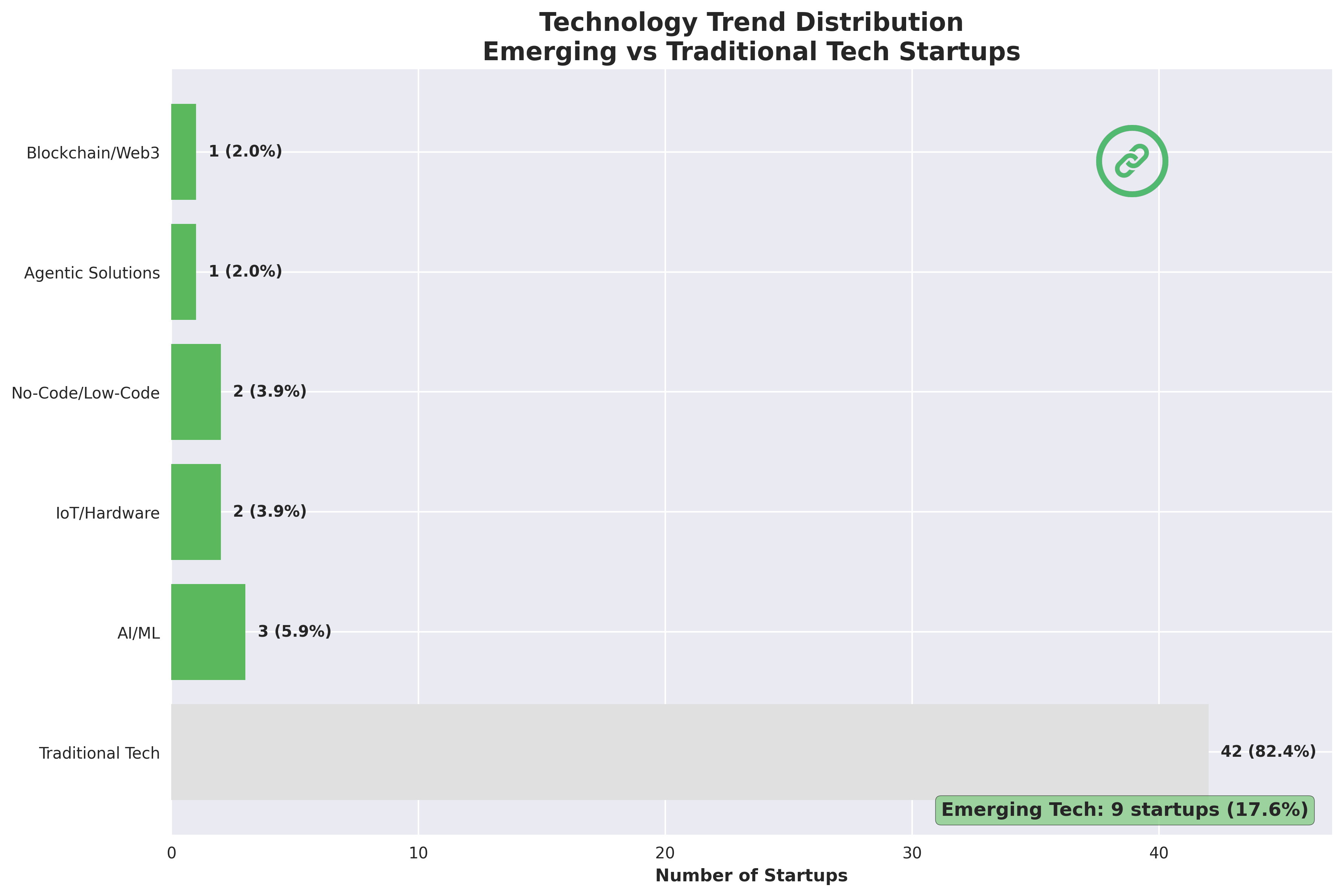

Technology Trends

A smaller but important share of startups—17.6%—are working on emerging technologies like AI/ML, IoT, blockchain, no-code, and agentic AI solutions. The majority, however, still operate in traditional tech (SaaS, e-commerce, digital services), suggesting the ecosystem is building foundational strength before scaling into frontier innovation.

Looking Ahead

The data paints a mixed but hopeful picture. Azerbaijan’s startup ecosystem has clear strengths: experienced founders, strong university connections, growing investment infrastructure, and early signs of global market access. At the same time, challenges remain: limited follow-up funding, high dormancy, and relatively low adoption of cutting-edge technologies.

For Azerbaijan to unlock its startup potential, the ecosystem will need stronger growth-stage capital, more international exposure, and targeted support to convert dormant ventures into active players. The foundation is here—the next step is building the support structures to scale it.